Buy

this stock before it takes off in 2023!

January 2nd, 2023, written by Crazy Miser

Key points:

-

Trading at a very attractive valuation

-

Earnings beat in struggling economy

-

Cuttings costs

- Holiday

sales

Analysis

Amazon is the top e-commerce company and one of the biggest cloud service providers around the world. They expanded their revenue by nearly 15% year over year in their Q3 earnings report during a weak economy. They have taken measures to cut costs, such as, layoffs, canceling warehouses, and shutting down Amazon Care. Despite this, retailers selling through Amazon reached sales hitting $1 billion across their Thanksgiving weekend. In stores, 123 million people participated in in-person shopping. Amazon continues to expand it's AWS footprint to reach customers in the Asia Pacific Region, in Thailand, Middle East, and the UAE region. Also, they introduced their first-ever Prime Early Access shopping event during October 11-12 only for Prime members where customers could find hundreds of thousands of deals in all best-selling categories. Also, they announced the availability of AWS IoT FleetWise to collect and transfer vehicle data to the cloud in near real time for automakers, suppliers, and fleet operators. We believe Amazon will beat most analysts expectations for Q4.

Valuation

|

We

believe Amazon is undervalued at it's current price due to

it's price-to-sales ratio of approximately 1.8, which has

not hit these levels since 2014. We believe Amazon offers a

low risk, high reward due to the current sales multiple and

future growth prospects. We believe the stock would be

fairly valued between $135-160 per share.

|

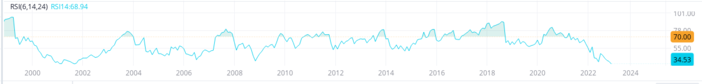

Technical Analysis

Webull.com

- Amazon Weekly Chart Webull Desktop

Want to join our FREE newsletter?

We

will notify you of new articles and updates to our stock

picks!

By submitting your email address, you agree that we can send you updates on our website as well as information about other goods and services we think you'll find interesting. You are always free to unsubscribe. Please read our Terms of Use and Privacy Policy.