Traditional

TSP vs Roth: Which is best for you?

July 28th, 2024, written by Crazy Miser

Traditional TSP:

|

Roth TSP:

|

Traditional TSP Analysis

The traditional TSP is better for those who plan on slowly taking out withdrawals once they hit the age of retirement as they will have a higher compounding interest than those who choose the option to invest using the Roth TSP. An Active Duty E-3 with less than 2 years of service can expect to make around $28,524 annually. If this individual contributes 22% of their income for the next 40 years to their traditional TSP they should expect to have around $3.36 million if their salary and inflation remain constant while the market returns a rate of 10.5%. Also, they would save nearly 20% more in their current tax bracket as opposed to utilizing the Roth TSP. However, this would not be the best option if you plan to take out a massive lump sum when you retire. Remember, the longer you keep your money in the market the more likely it is to grow. Time in the market = more money in the market!

Roth TSP

Analysis

The

Roth TSP is better for those who plan to take out a lump sum once

they retire. You could use this large lump sum to buy your dream

home or yacht at 59.5 years old. An

Active Duty E-3 with less than 2 years of service can expect to make

around $28,524 annually. If this individual contributes 22% of their

income to their Roth TSP for the next 40 years they should expect to

have around $2.92 million if their salary and inflation remain

constant while the market returns a rate of 10.5%. Those who choose

this option will have less money going into their retirement account

each paycheck compared to those who choose the Traditional TSP due

to the contributions being post-tax.

The Data

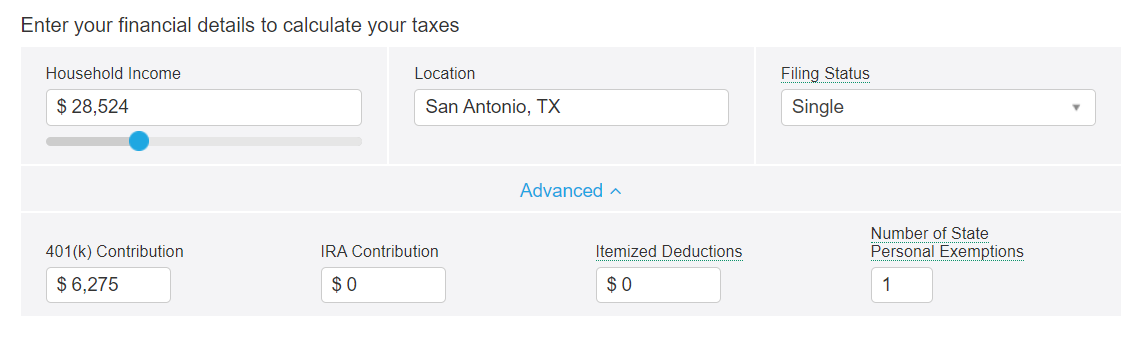

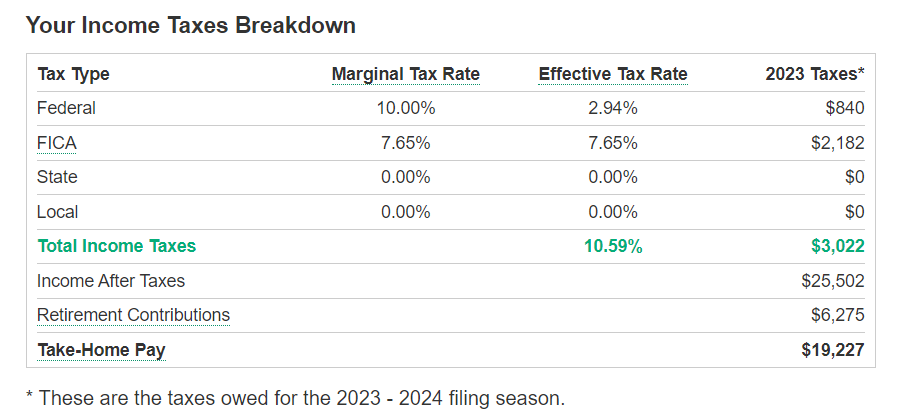

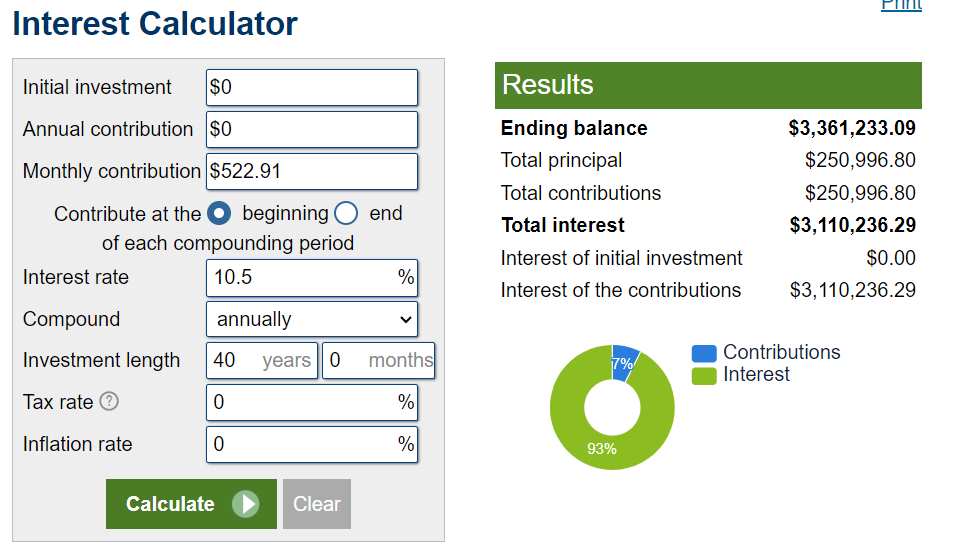

Traditional TSP In this instance, the E-3 contributes 22% of their annual salary to their Traditional TSP. |

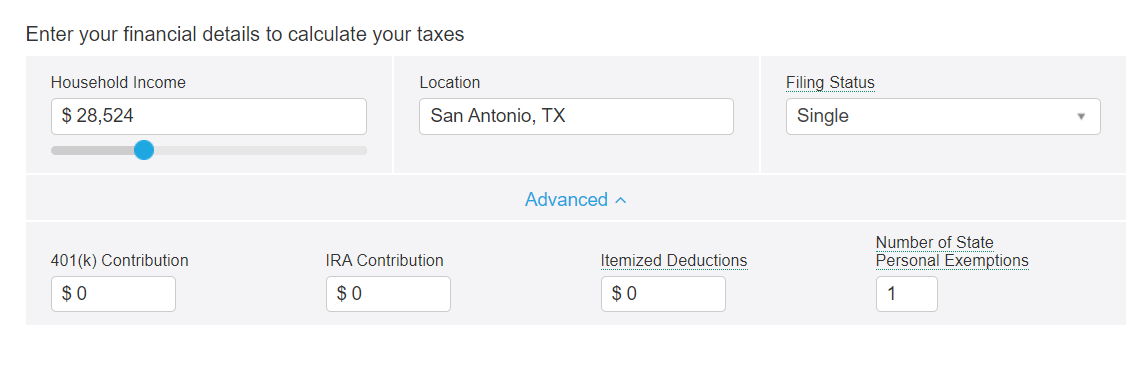

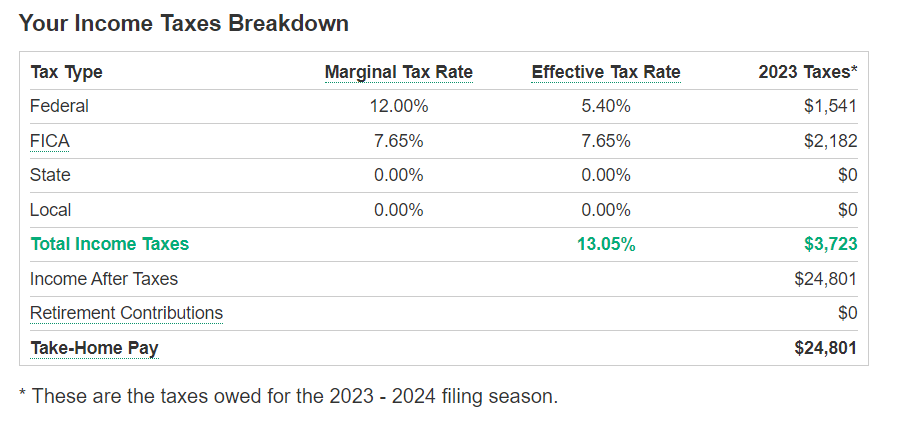

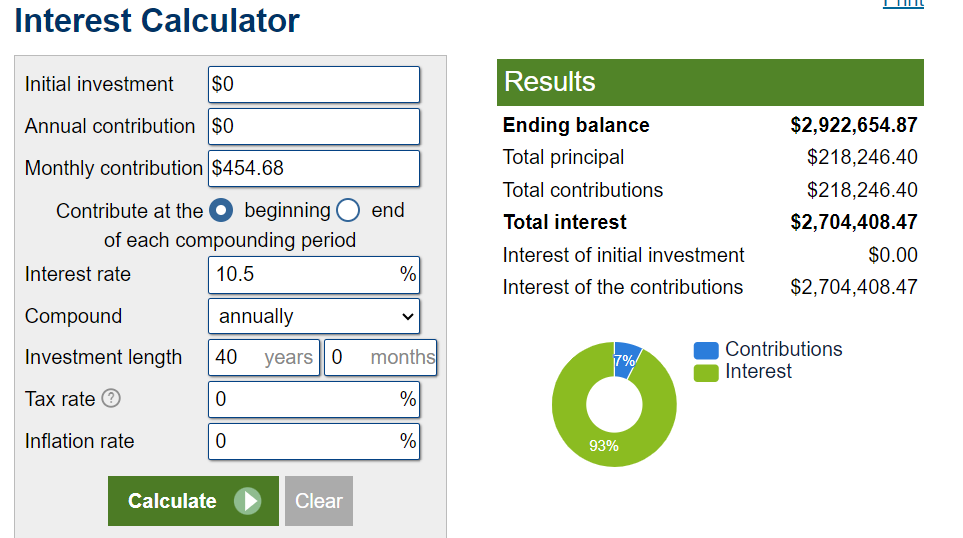

Roth TSP

In this instance, the E-3 contributes 22% of their annual salary to the Roth TSP (POST-TAX). |

In this instance, the E-3

pays $3,022 in tax and their income after tax is $25,502

while contributing $6,275.00 to the TSP ($522.91 per month).

|

In this instance, the E-3

pays $3,723 in tax and their income after tax is $24,801.

22% of their salary would be $5,456.22 ($454.68 per month).

|

In this instance, the E-3

has a total ending balance of $3,361,233.09 while

contributing $522.91 per month (22% pre-tax base

pay) and growing at an interest rate of 10.5% per year

(average return from S&P 500).

|

In this instance, the E-3

has a total ending balance of $2,922,654,87 while

contributing $454.68 per month (22% post-tax base pay) and

growing at an interest rate of 10.5% per year (average

return from S&P 500).

|

The example above does not include rank progression, special duty pays, or any type of bonus pay. For simplicity, it only represents someone who maintains the same salary for the entirety of their career while disregarding inflation. Therefore, these numbers will likely be much different based on your contribution percentage, current rank, bonuses, and specialty pays.

What should you do?

You should choose the retirement plan that will help you achieve your goals. Do you want to take out a large lump sum at age 59.5 to buy your dream home? Roth TSP is probably best for you. Do you want to have a higher compound interest rate and slowly take out your money during retirement? Traditional TSP is probably the choice for you.

For example, if you live in San Antonio, TX and slowly take out $40,000 to $50,000 each year while paying $6,000-8,000 in tax for 24-30 years then you will have more money than someone who takes out a lump sum at 59.5 years old due to your money being in the market for longer. Finally, the $40,000 to $50,000 that you take out each year will become your new income so you will be taxed at that rate, however, if you are still working in your late 50's or 60's and pull from your TSP then you will pay more in tax based on how much you currently make.

Personally

I do not plan on buying a yacht or mansion at 59.5 years old so, I

would contribute a percentage of my money that I feel comfortable with

to my Traditional TSP. Next, I would put the maximum amount into a

Roth IRA (current 2024 maximum is $7,000). Finally, any money that I

would have left for investments would be put into a brokerage account.

You can learn how to open a Roth IRA and Brokerage using Fidelity here.

Want to join our FREE newsletter?

We

will notify you of new articles and updates to our stock

picks!

By submitting your email address, you agree that we can send you updates on our website as well as information about other goods and services we think you'll find interesting. You are always free to unsubscribe. Please read our Terms of Use and Privacy Policy.